If you claim Universal Credit you get a Standard Allowance in the calculation. This is:

- £257.33 per month if you are single and under 25

- £324.84 per month if you are single and aged 25 or older

- £403.93 per month for a couple where both member are under 25

- £509.91 per month for a couple where one or both partners are aged at least 25

This is the basic needs level, and for many people it is all that they get.

On training courses people often ask me what this amount is supposed to cover, and I tell them that the law doesn’t say.

Which is true.

But if, like me, you are an old-hand, you can see that there is a history to this standard allowance.

Back in the Day

Back in the day, many years ago, when I was a young man, there used to be a means-tested benefit called Supplementary Benefit which was a single means-tested benefit for anyone who was not in full-time work.

The last time that I claimed benefit, between leaving college and starting work, I got Sup-Ben.

In April 1988 Sup-Ben was replaced by Income Support which was also for anyone who was not in full-time work.

Over the following years Income Support was fragmented into different benefits for different categories of people:

- In 1996 people who were looking for work were taken out of Income Support and for them, the same benefit was called income-based Jobseeker’s Allowance

- In 2003 older people were taken out of Income Support and they got a basically identical benefit called Guarantee Credit of Pension Credit (Ffs!)

- In 2008 the benefit for people whose illness or disability caused barriers to working was re-named income-related Employment and Support Allowance.

What Comes Around Goes Around

And now we have Universal Credit, in which all those different categories of people, except pensioners, are being bundled into the same benefit.

UC is taking a long time coming. It started in 2012 with the Welfare Reform Act, finally went national in 2019, but still hasn’t get been fully implemented.

But What About the Standard Allowance?

Well here is the reason for telling you the history.

The law of Universal Credit doesn’t say what your Standard Allowance is supposed to cover, but the amount was initially set at exactly the same level as the Personal Allowance in Income Support, ESA and JSA. And still, it’s basically the same figure.

The law of Income Support, ESA and JSA doesn’t say what your Personal Allowance is supposed to cover, but he amount was initially set at exactly the same level as the Normal Requirements in Supplementary Benefit.

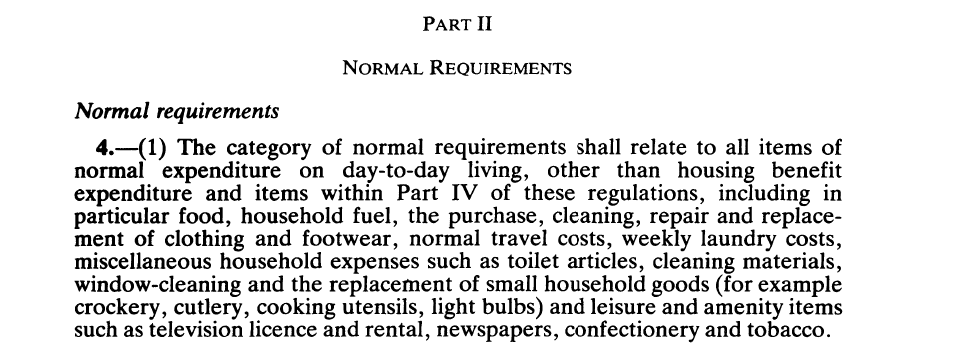

And the law of Sup-Ben did include a list of what this allowance was supposed to pay for. And here it is:

- Food,

- household fuel,

- the purchase, cleaning, repair and replacement of clothing and footwear,

- normal travel costs,

- weekly laundry costs,

- miscellaneous household expenses such as toilet articles, cleaning materials, window cleaning and the replacement of small household goods (for example crockery, cutlery, cooking utensils and light bulbs) and

- leisure… items such as television license and rental, newspapers, confectionary and tobacco.

Of course, in those days we used to have the DHSS – The Department of Health and Social Security.

Government policy recognised that people’s health was intimately connected with their security within their society.

And nowadays we have the DWP – Work and Pensions.

And a benefits system that starves vulnerable people into ill health and disability

And then, incidentally, we can claim slightly more for them on that basis.

This is Regulation 4 of The Supplementary Benefit (Requirements) Regulations 1983 SI No. 1399