Hi Yoda,

My service-user Marta is 47, single and lives in a housing association property

She’s been off sick from work getting Statutory Sick Pay but this is coming to an end soon.

She’s been given conficting advice abut whether she should claim ESA.

Her work-coach says that there’s no point, cos the same amount will be deducted from her Universal Credit.

Someone else at the DWP said that she must claim ESA to get her NI credits.

What should she do?

Ta

Paula

Hello Paula

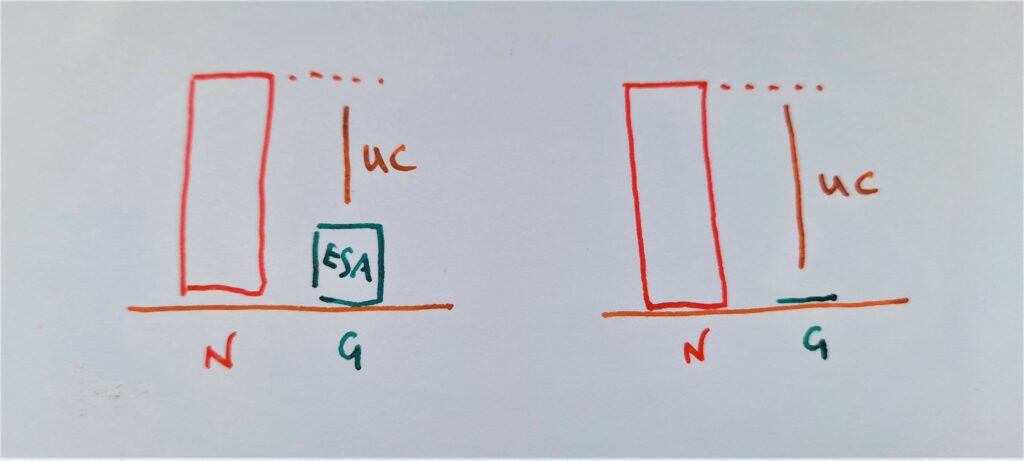

If you are getting Universal Credit, there is no point claiming ESA:

Universal Credit is a means-tested benefit where each claim is worked out using a need-vs-got calculation.

When the DWP works out your Universal Credit, they count your ESA as your income.

So the amount of money that Marta would get from ESA and UC combined is exactly the same amount that she would get from only claiming Universal Credit.

ESA would be important if she had a working partner. ESA is an individual benefit, where UC looks at both members of a couple.

ESA would be important is she had more than £16,000 capital. ESA is non-means-tested, where UC has a £16,000 savings limit

But Marta is single and has no savings, so I can see what the work-coach means when she says that there is no point claiming ESA.

But it’s a bit more nuanced than that:

To get ESA you must have worked and paid National Insurance in the couple of years before you make your claim.

So you have a limited time after you stop work, to qualify for ESA.

For Marta the window to claim ESA claim ends on the last day of 2025.

So, arguably Marta should claim the ESA while she can, in case her circumstances change in a way that would cause the Universal Credit to stop. Maybe if she wants to move in with a partner, or maybe if she somehow gets increased capital.

But there is further complication:

People who have Limited Capability for Work Related Activity get an indefinite ESA award.

So, if Marta has a severe condition, she can claim now, and the ESA will just keep on going.

But people with less severe conditions (Limited Capability for Work but not LCWRA) only get ESA for one year.

So if Marta does not qualify as having LCWRA, she should delay claiming until she actually gets the lottery-win or partner. (Or until December 2025)

And finally,

National Insurance Credits, to protect her eventual State Pension are irrelevant. These credits can come with both ESA and UC

And, finally, finally,