Hi Mike,

My service user claimed Carer’s Allowance and the DWP deducted the same amount off her Universal Credit.

So there was no point claiming Carer’s Allowance?

Ta

Joanna

Hello Joanna

Carer’s Allowance

If you spend 35 or more hours each week caring for someone who gets PIP-Daily-Living, or Attendance Allowance or DLA-Care at the middle or high rates you can claim Carer’s Allowance of £76.75 per week.

Because Carer’s Allowance is a non-mean-tested benefit, it is an individual entitlement. If you have a partner, they are irrelevant to your claim.

Because Carer’s Allowance is non-means-tested your savings are irrelevant.

Mostly, your other income is irrelevant to Carer’s Allowance, but because it is an instead-of-a-wage benefit, you cannot have it if you have a wage of more than £139.00 per week.

Because Carer’s Allowance is an instead-of-a-wage benefit, the overlapping benefit rule applies.

You can only claim one non-means-tested instead-of-a-wage benefit at any one time.

If you meet the rules for more than one of this type of benefit, you get the one that gives you the better deal

Most commonly, someone who gets State Retirement Pension, or Maternity Allowance or contributory-ESA cannot get Carer’s Allowance because these benefits all overlap.

Carer’s Allowance has some complicated relationships with other benefits.

Whether or not you should claim will depend on what other benefits you and the person that you are caring for get:

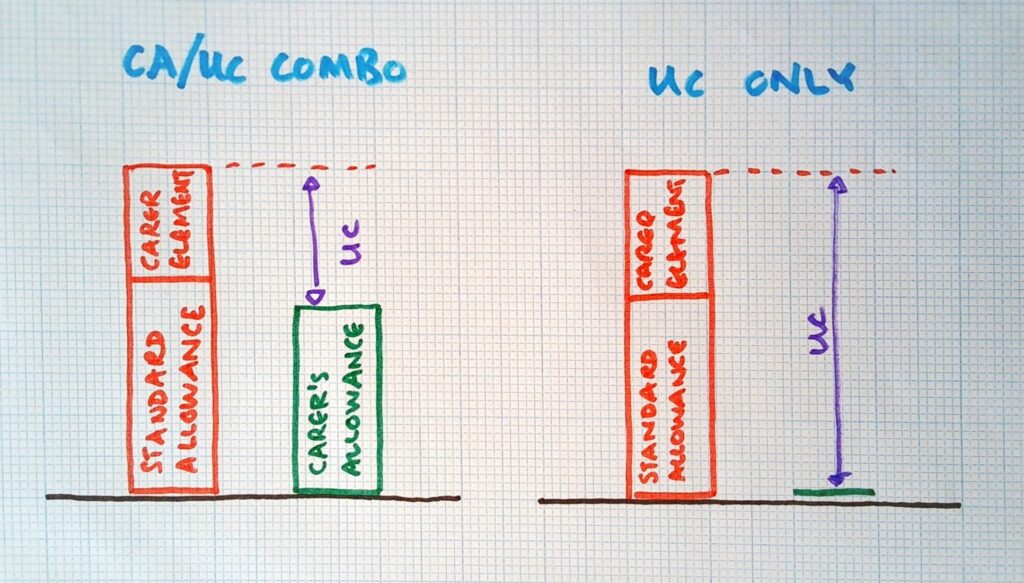

If you are getting Universal Credit, there is no point claiming Carer’s Allowance:

Universal Credit is a means-tested benefit where each claim is worked out using a need-vs-got calculation.

When the DWP works out your Universal Credit, they count your Carer’s Allowance as income.

So the amount of money that you get from Carer’s Allowance and UC combined is exactly the same amount that you get from only claiming Universal Credit.

Here it is as need-vs-got diagrams:

If you are claiming legacy benefits – You might have to make a claim for Carer’s Allowance to be recognised as a carer.

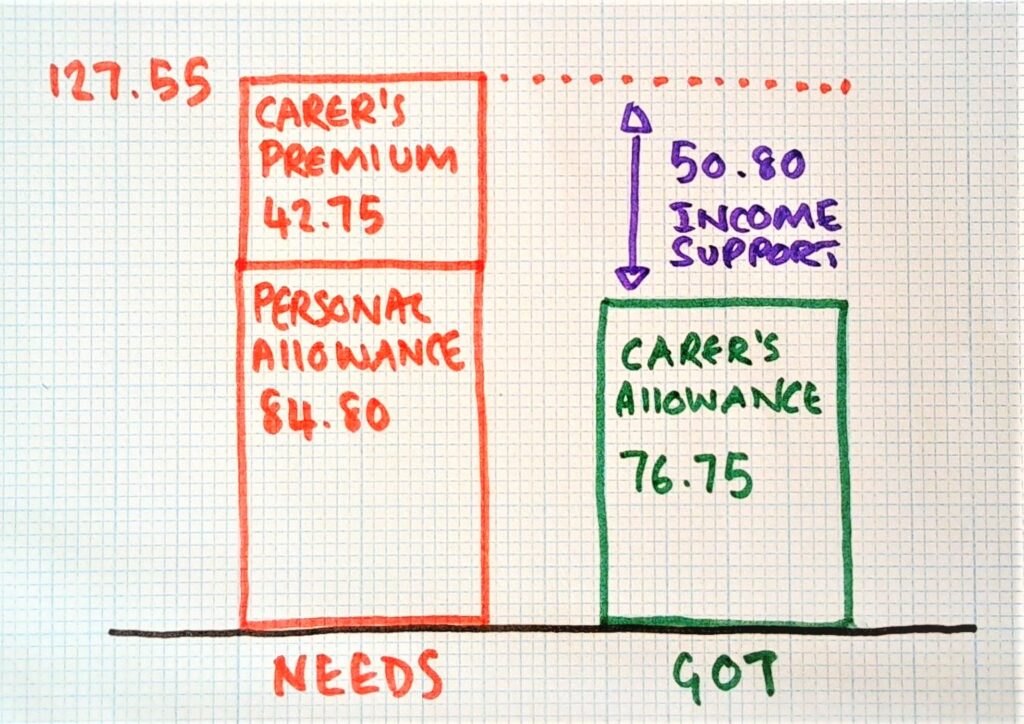

Anna is getting Income Support (from before Universal Credit arrived) because she cares for her mother.

Income Support is a means-tested benefit where each claim is worked out using a need-vs-got calculation

Here is Anna’s Income support calculation:

Anna had to make a claim for Carer’s Allowance to qualify for a booster Carer’s Premium in her Income Support needs-level.

But Income Support counts the Care’s Allowance as part of her income, so it is given with one hand and taken with the other.

But the final result for Anna is that she gains £42.75 by claiming Carer’s Allowance.

If you are aged 66 or over

You can claim Carer’s Allowance – but you probably won’t get it because it overlaps with State Pension.

But, if you are also claiming Pension Credit, Housing Benefit or Council Tax Reduction it might be worth claiming the Carer’s Allowance, even though you know that you are not going to get it.

These mean-tested-benefits all use a what-you-need-vs-what-you’ve-got calculation.

If you qualify for Carer’s Allowance, the needs-level used by the means-tested benefit includes an extra booster Carer’s Premium (just like Anna, above).

But, to get the booster premium in your Pension Credit you must:

- Claim the Carer’s Allowance.

- Get the underlying-entitlement decision letter that says that although you meet the rules for Carer’s Allowance you cannot have it because of the overlap.

- Send the Carer’s Allowance decision letter to Pension Credit and/or Housing Benefit so that they know to include the Carer’s Premium in your benefit.

But Beware!

If the person that you care for gets legacy benefits or Pension Credit

If the person that you help gets legacy benefits or Pension Credit and:

- they live alone, or,

- all other people who live with them also get PIP-Daily-Living, or Attendance Allowance or DLA-Care at the middle or high rates,

their benefit probably Includes and extra booster called a Severe Disability Premium of £76.40 per week.

If you get Carer’s Allowance, or Universal Credit Carer Element for looking after them, they will lose this