This post was written in 2021, so the amounts are now out-of-date, but the ideas are still completely valid.

Old-Style ESA and New-Style ESA

Employment and Support Allowance is a benefit for people whose illness or disability means that they have limited capability for work

If you’ve claimed ESA since Universal Credit arrived in your area, the DWP will call it new-style ESA. That’s not what this post is about.

If you made your claim for ESA before Universal Credit arrived, the DWP will call it old-style-ESA.

Old style ESA has two parts: Contribution-based and Income-related.

Old-style ESA is closed for new claims, but if you are still getting old-style contribution-based ESA you might be able to get more money by asking for a new award of income-related ESA.

And any increase that you get through ESA may be carried through to Universal Credit when you migrate to the new benefit.

Contribution Based ESA

To get contribution-based ESA you must have worked and paid National Insurance in the couple of years before you make your claim.

Old-style contribution-based ESA is a non-means-tested benefit. In almost every case it’s a flat-rate of £114.10 per week.

Because it’s a non-means-tested benefit it’s an individual entitlement. You can claim it regardless of whether or not you have a partner.

Income Related ESA

Income-related ESA is a means-tested benefit. If you have a partner, you must make a joint claim.

Because its a means-tested benefit, every claim gets its own needs-vs-income calculation.

The DWP works out how much you need to live on each week, using a menu of government figures.

If your income, including cESA, is less than your needs-level, you get a top-up of income-related ESA.

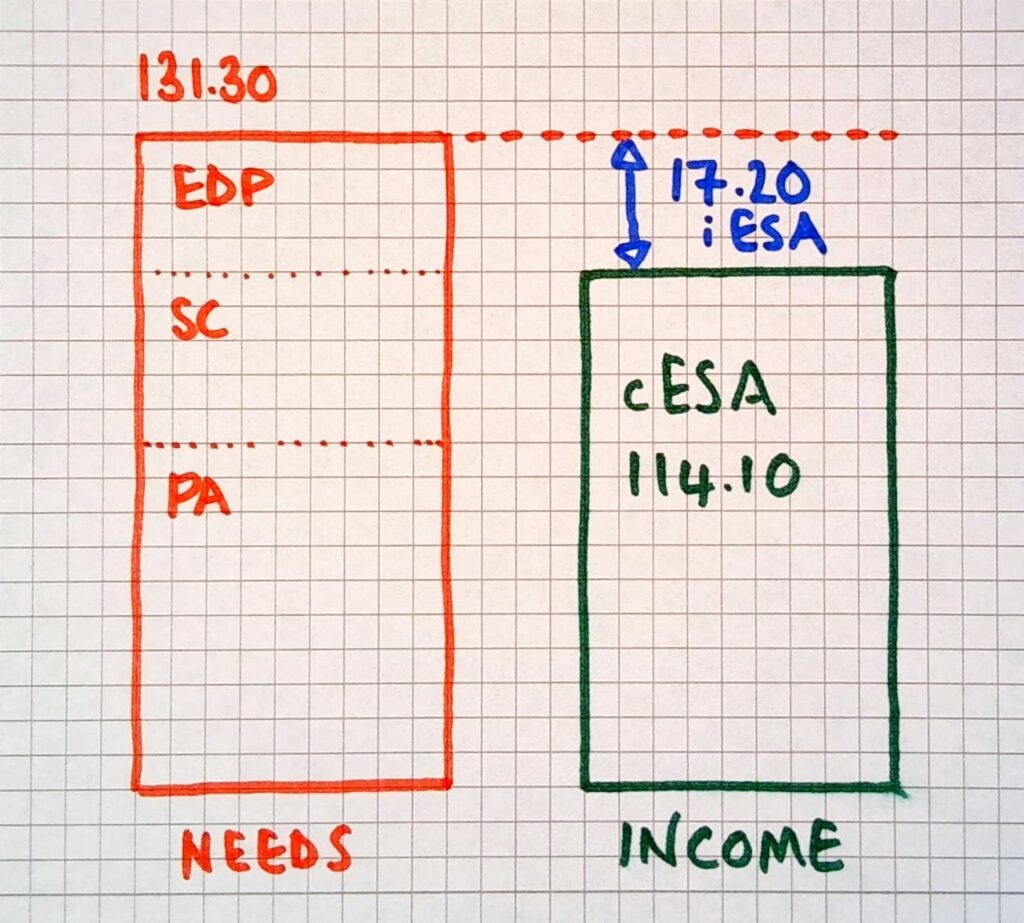

Combining Both Parts of ESA – An Example – Amanda

Amanda (40) is single. She worked until she became ill in 2017.

She doesn’t get PIP.

She gets old-style contribution-based ESA of £114.10 per week.

Income-related ESA thinks that she needs £131.30 per week. (Personal Allowance, Support Component, Enhanced Disability Premium).

She gets an iESA top-up of £17.20 per week.

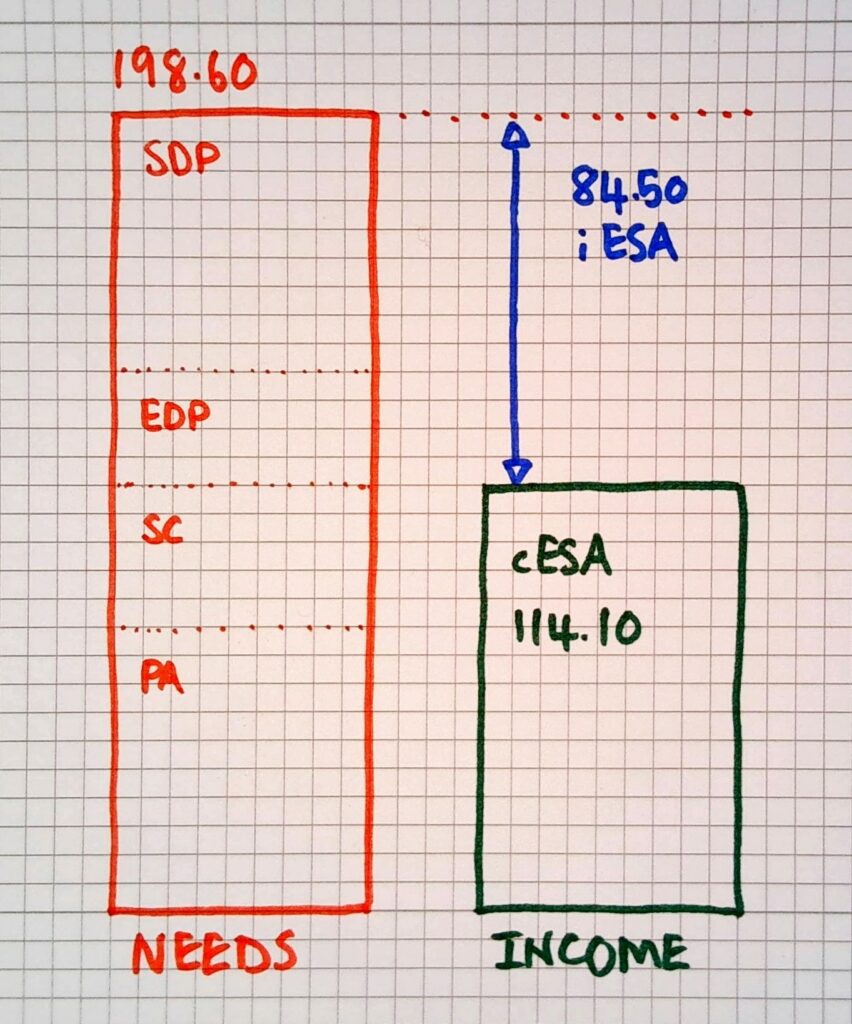

Combining Both Parts Of ESA – An Example – Zoe

Zoe (40) is single, She worked until she became ill in 2017.

She gets PIP Daily Living Component. This does not count as income in the iESA calculation.

She gets old-style contribution-based ESA of £114.10 per week.

Income-related ESA thinks that she needs £198.60 per week. (Personal Allowance, Support Component, Enhanced Disability Premium, Severe Disability Premium).

She gets an iESA top-up of £84.50 per week.

Getting a New Award of IESA

It’s quite common that people who get old-style, contribution-based ESA are missing out on the extra bit from income-related ESA.

Often, if they contact the DWP to ask for the extra money they will be told Sorry! Income-related ESA is closed for new claims.

That’s correct, but if you are already getting contribution-based ESA the award of extra income-related isn’t a new claim.

Point this out to the person at the DWP and they will usually sort this out for you without too much fuss – Though you will have to complete and return a form ESA3, with details of your income and savings.

For nerdy readers, this is a link to the relevant Upper Tribunal decision.

Is Everyone Who Gets Old-Style Contribution-Based ESA Also Entitled To A Top-Up from Income-Related?

No. The Amanda and Zoe examples are very straightforward because they’re single and they have no other income.

If you have a partner your situation will be a bit more convoluted. But you may be able to get extra money, so get advice.

If you have other income, such as a private pension, this might be taken into account in the needs-vs-income calculation (a private pension definitely would).

If you have savings of between £6,000 and £16,000 this wil affect how much you get.

If you have more than £16,000 you cannot get iESA – usually.

The needs-level for old-style ESA is individually worked out for each claim. For single people the amount used for Amanda and Zoe are most common.

The current figures are:

Old-style contribution-based ESA £138.20.

Amanda’s needs-level £159.05 and her iESA top-up £20.85

Zoe’s needs-level £240.55 and her iESA top-up £102.35