May works part time earning £1,100 per month.

She lives on her own in a mortgaged house.

She has significant health difficulties and she gets PIP-Daily-Living-Component at the low rate.

She tried claiming Universal Credit but was told that her income was too high.

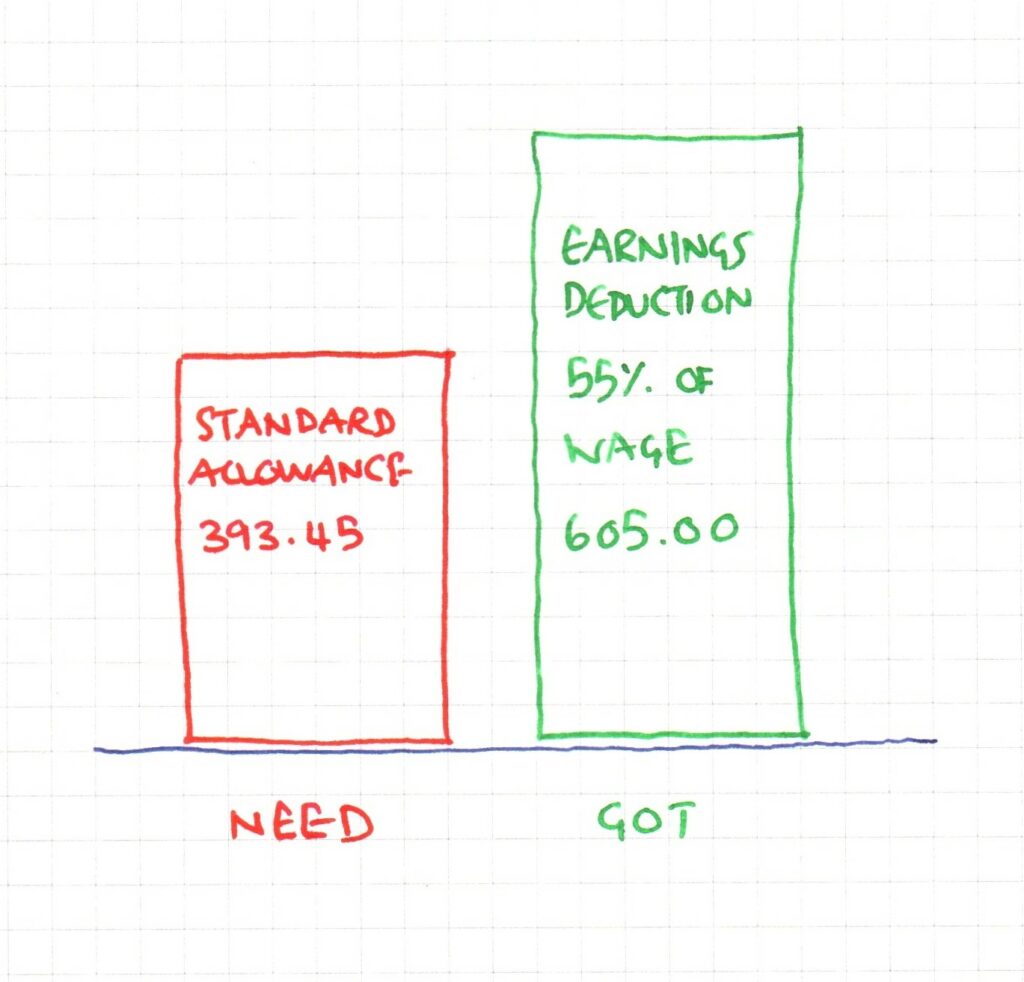

UC thinks that she needs just £393.45 per month – and counting 55% of her wage she’s got £605 per month so she’s way too rich.

May got in touch with me to ask if this is correct

It is, but she took my advice and got a sicknote from her GP

The GP was a bit puzzled because they usually they get asked for sicknotes when people are not working because of illness – where May is currently in work, and does not want to stop.

But a sicknote (legally called a Health Professional’s Statement – btw) does not necessarily mean that you are not well enough to work.

Rather, a sicknote says that you have a health condition that puts barriers in the way of working – which is definitely true for May

Then May re-claimed Universal Credit submitting the sicknote with the claim.

The new claim was also turned down…

… but the DWP kept it on the system while May was referred for a Work Capability Assessment.

She went through the usual process (sick-note > UC50 form > phone-assessment > decision)

And yesterday she got a decision that she has Limited Capability for Work

What Now?

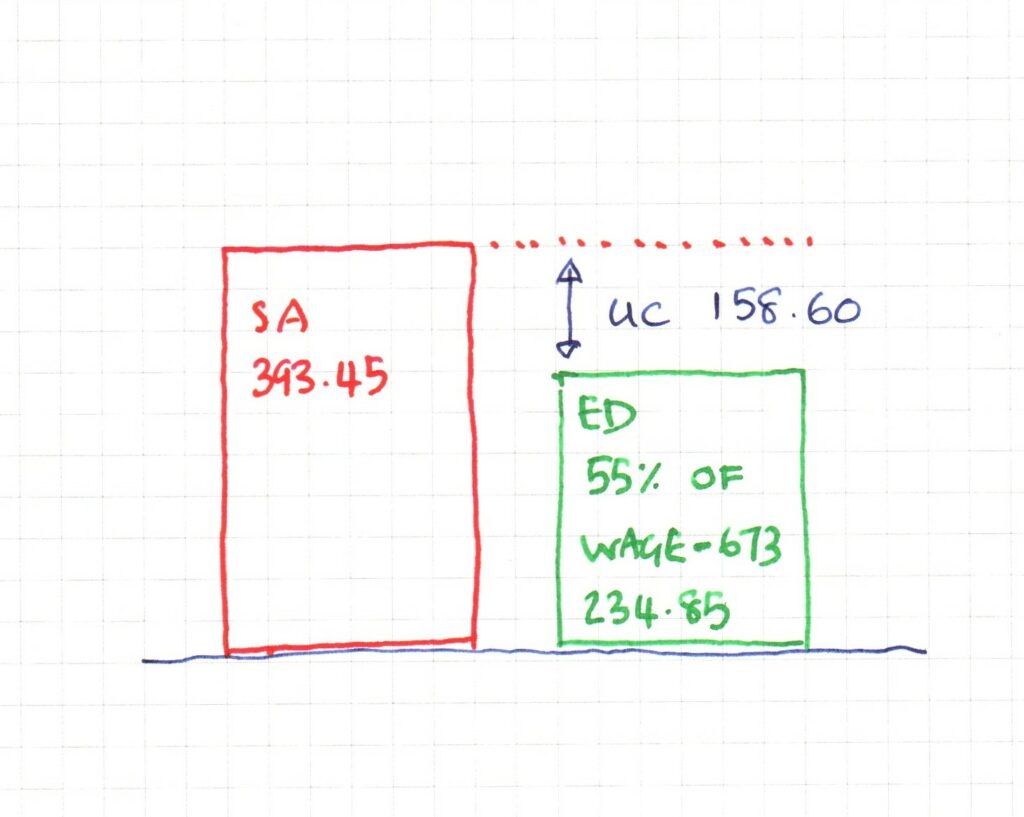

Now May has got the LCW decision this means that she qualifies for a Work Allowance.

A Work Allowance is where Universal Credit ignores part of your wage before doing the Got-vs-Need calculation.

In May’s situation they ignore £673 per month from the wage.

This leaves £427 of wage, and UC counts 55% of that in the calculation.

So May is now entitled to Universal Credit of £158.60 per month – with back-payments from the start of this UC claim

Is it always like this?

No!

People who have children included in their claim also qualify for Work Allowances. If May was claiming for a child we would not have needed to do this.

The DWP did the Work Capability Assessment on May, even while she was working, because she also gets PIP.

If you don’t get PIP the DWP can only do a WCA on you if you are earning less than £793.17 per month.

If you qualify for a Work Allowance, but your UC includes money for rent, they will ignore £404 per month of your wage.

May got the higher Work Allowance because she’s not getting help with rent.