Hello Mike

My client Corinne is being bedroom-taxed because she has a spare bedroom in her housing association flat.

Her friend Josie wants to move in.

Will this undo the bedroom tax? How will this affect Corrine’s other benefits

Alice

Hello Alice

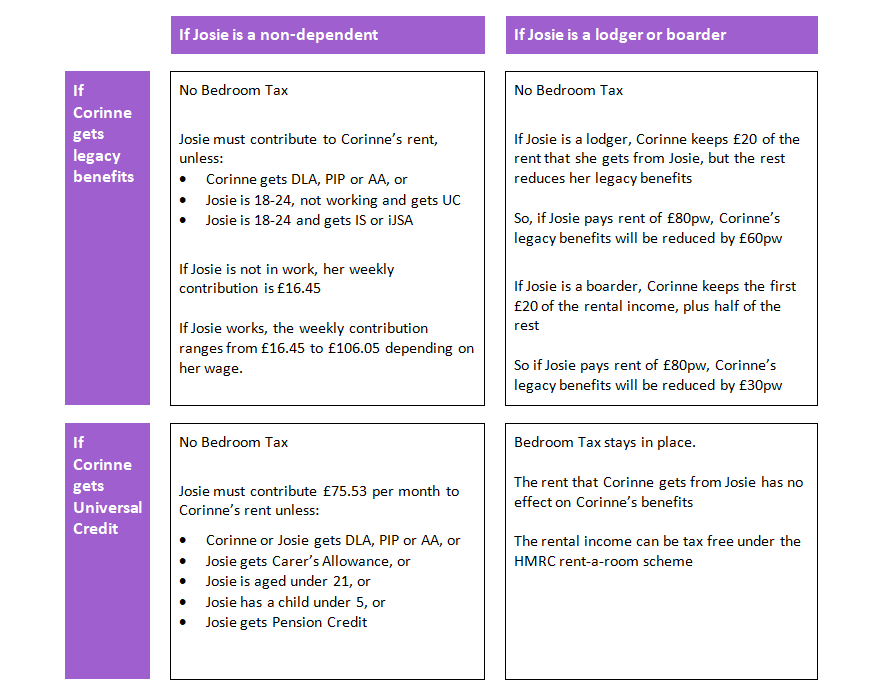

The answer depend on whether Corinne is getting Universal Credit or legacy benefits; and on whether Josie will be a non-dependent, a lodger or a boarder.

Josie would be:

- a non-dependent if she shares the flat on a non-commercial basis, without paying rent to Corinne.

- a lodger if she rents a room from Corinne.

- a boarder if she rents a room and also gets meals.

The Possibilities:

Josie’s Claims

If they decide to go for a lodger or boarder arrangement, Josie can claim Universal Credit Housing Costs Element or Housing Benefit to cover the rent that she must pay to Corinne.

The amount that she gets depends on the normal UC or HB rules for private tenancies.