Who Counts as A Carer?

In the benefits system you count as a carer if you spend at least 35 hours each week caring for someone who gets PIP Daily Living Component, or Attendance Allowance, or Disability Living Allowance Care Component at the middle or high rates.

- If you get PIP-DL, or AA, or DLA-CC you can only have one person who counts as your carer.

- If you care for more than one person you can only count as a carer for one of them.

- To count as a carer you must spend at least 35 hours caring for one person. A total of 35 hours care for more than one person won’t count.

- Partners can count as each-other’s carers.

What Can Carer’s Claim?

If you are aged at least 16 and you earn less than £128 per week can claim non-means-tested Carer’s Allowance of £67.60 per week. You can’t have this if you are in education for 21 or more hours each week.

If you are claiming Pension Credit, Income Support, income-related ESA or income-based JSA you can have a Carer’s Premium of £37.70 per week included in your award. To get this you must make a claim for Carer’s Allowance so that the DWP can confirm that you count as a carer.

If you are claiming Universal Credit you can have a Carer Element of £163.73 per month included in your award. You do not have to claim Carer’s Allowance to qualify for this extra element. You just have to tell the Universal Credit department that you meet the conditions to count as a carer.

If you begin caring for someone before their DLA/PIP/AA is awarded there are rules that allow your carer’s benefits to be back-paid once the DLA/PIP/AA comes through.

Universal Credit sometimes says that this is not possible and so, if you don’t get help dealing with this, you might miss out on your extra element for the time between the start of the DLA/PIP/AA award and the time when you tell them that you are a carer.

Prevent this problem by telling Universal Credit as soon as you begin caring for someone, even if their DLA/PIP/AA has not yet been awarded.

How Does this Affect the Person That You’re Caring For?

Pension Credit, Income Support, income-based JSA and income-related ESA can all include a Severe Disability Premium of £67.30 per week for people who get PIP Daily Living Component, or Attendance Allowance, or Disability Living Allowance Care Component at the middle or high rates.

You can find out the details of the Severe Disability Premium here

One of the basic rules for this extra premium is that nobody should be getting Carer’s Allowance or Universal Credit Carer Element for looking after you.

So a claim by a carer can cause the person being cared for to lose this vital extra allowance.

Query Number 1

Hi Mike,

My client Anna and her boyfriend have separate license agreements for rooms in our hostel. Anna gets ESA. Her boyfriend gets Universal Credit. She has just been awarded PIP Daily Living and they want to know how he could go about claiming as her carer.

Thanks

Amanda

Because Anna has now got the PIP award she can qualify for the extra Severe Disability Premium of £67.30 per week in her ESA. This can be back-paid to the start of the PIP award.

If Anna’s boyfriend tells Universal Credit that he is her carer he will gain an extra Carer’s Element of £167.30 per month or £38.61 per week, but this will stop Anna’s £67.30 SDP.

Once he counts as a carer, the boyfriend will no longer have to jobseek, but this will cost £28.69 between the two of them.

Carer’s Allowance is irrelevant to their situation. He does not have to claim it to count as a carer. If he does claim it, the same amount will be deducted from his Universal Credit.

Query Number 2

Hiya Mike

Becca is a lone parent of Ben (4). She gets Income Support, Child Tax Credit and Housing Benefit. Ben has just been awarded DLA Care middle-rate.

How does this affect Becca’s situation?

When she called the DWP she was told that she would have to move over to Universal Credit to claim as Ben’s carer. Is this right?

Thank you

Jacqui

Becca should let Child Tax Credit know about Ben’s award of DLA. She will then qualify for an extra Disabled Child Element in the CTC award.

Although it’s true that Becca could claim Universal Credit if she wanted to, this would be a big mistake.

The extra allowance for Ben’s disability in Child Tax Credit is £286.25 per month. In Universal Credit the equivalent element is £128.89 per month.

Fortunately, she does not have to claim UC and can stay on Income Support.

Income Support is a benefit for people who have a good reason for not job-seeking.

She currently gets it because she is a lone parent of a child aged under five.

But being a carer also counts as a good reason for not job-seeking so she can stay on IS even after Ben’s fifth birthday.

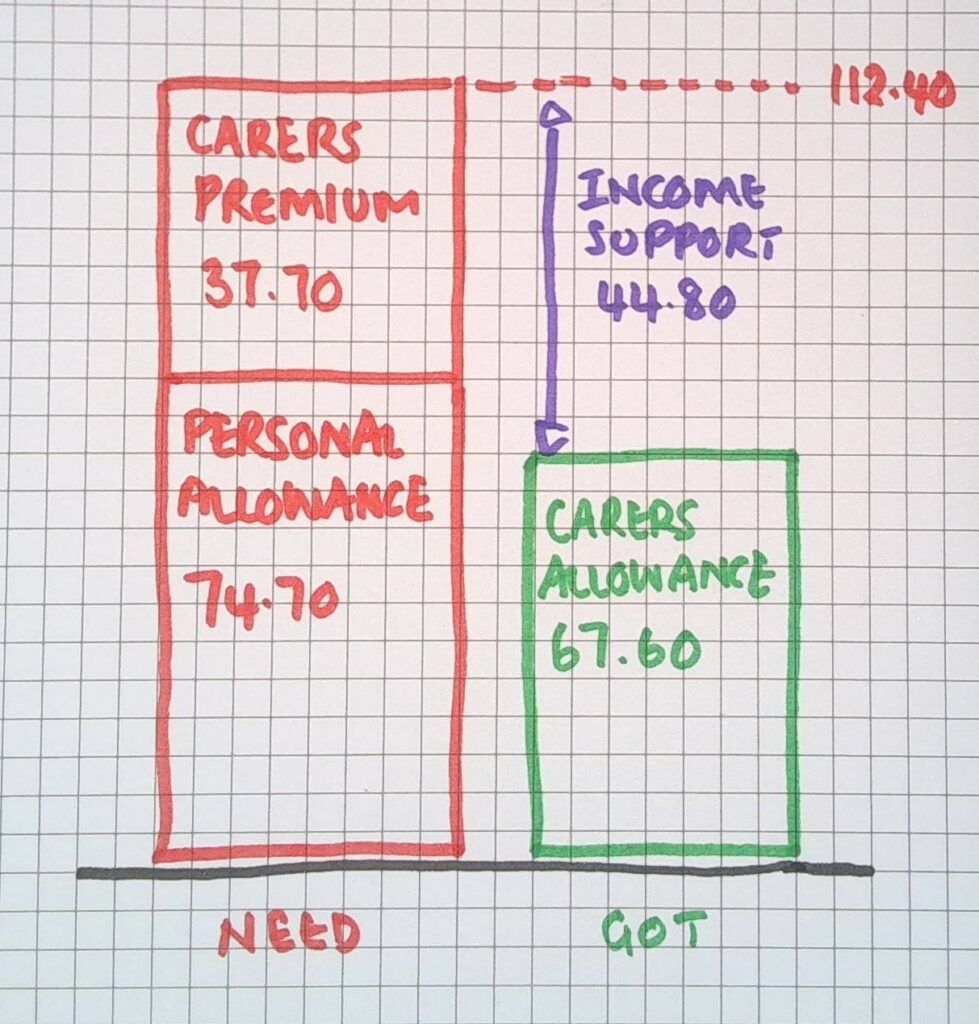

She must make a claim for Carer’s Allowance to show that she is a carer. The Carer’s Allowance will count as income for the IS calculation, but counting as a carer will add the extra Carer’s Premium into the Income Support needs-level (applicable amount)

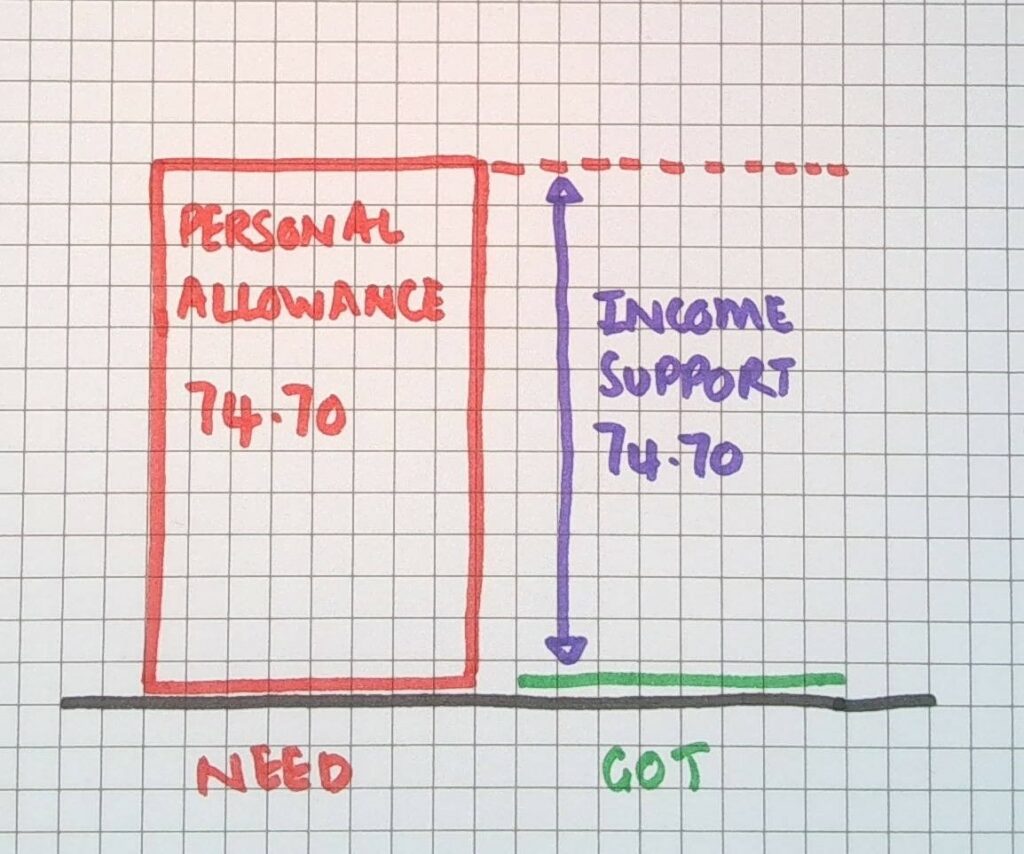

She will go from this situation:

To this situation:

Follow this link to find out about two people claiming as carers for each other.

Follow this link to read about older carers and Pension Credit