Update May 2023: The amounts shown in this post are now out of date. The concepts are still valid.

Hello Mike,

I visited a couple today to complete a PIP claim. She is 63, he is 65.

He had a car accident in Feb this year. His partner said that he had signs of dementia before the accident, but now he is a lot worse.

Anyway….

She works and usually she brings home around £720 a month.

They own their home, but are selling it because they can’t afford the mortgage payments.

They have been told that they are not entitled to any benefits, do you think that is correct?

Thanks Mike

Tracey

Hello Tracey,

Whoever told them that they are not entitled to benefit is wrong!

They should claim Universal Credit.

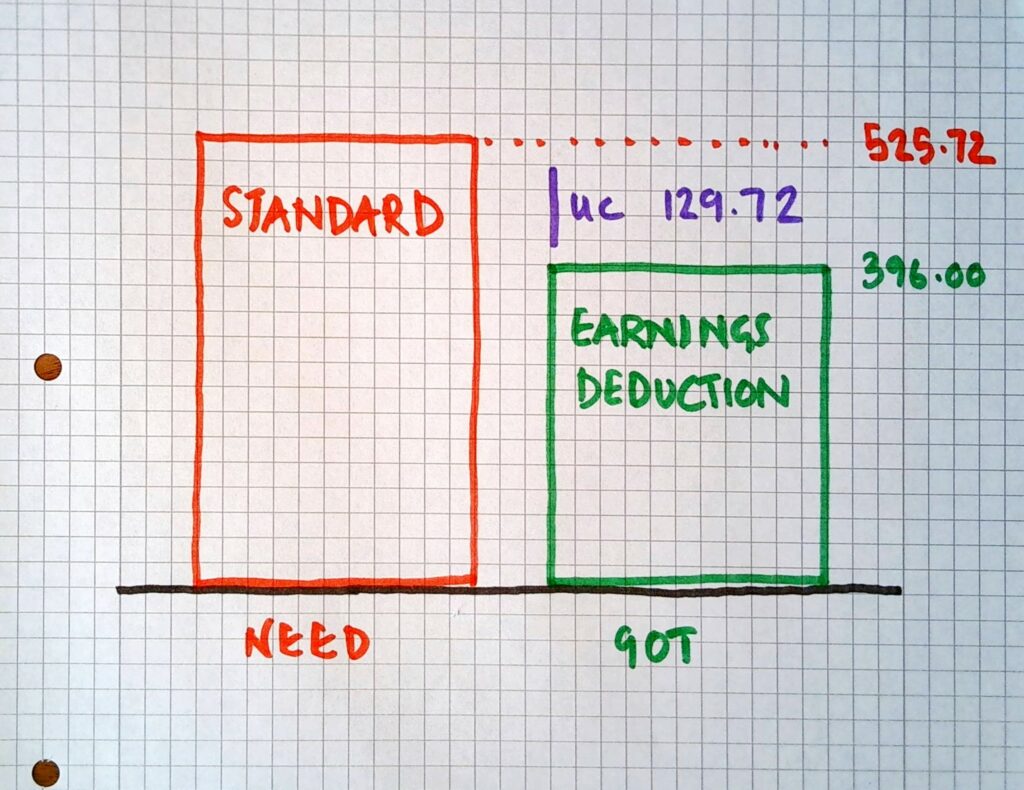

Right now, they will get £129.72 per month.

The standard allowance for a couple is £525.72 per month. This is the amount that Universal Credit thinks that they need each month.

This is what they would get if she was not working.

But because of her wage, UC makes an earnings deduction of 55% of the wage from this. [£720 x 0.55 = £396]

Drawing this out as a what-you-need-vs-what you’ve-got diagram we get this:

Getting More – Because She Is His Carer

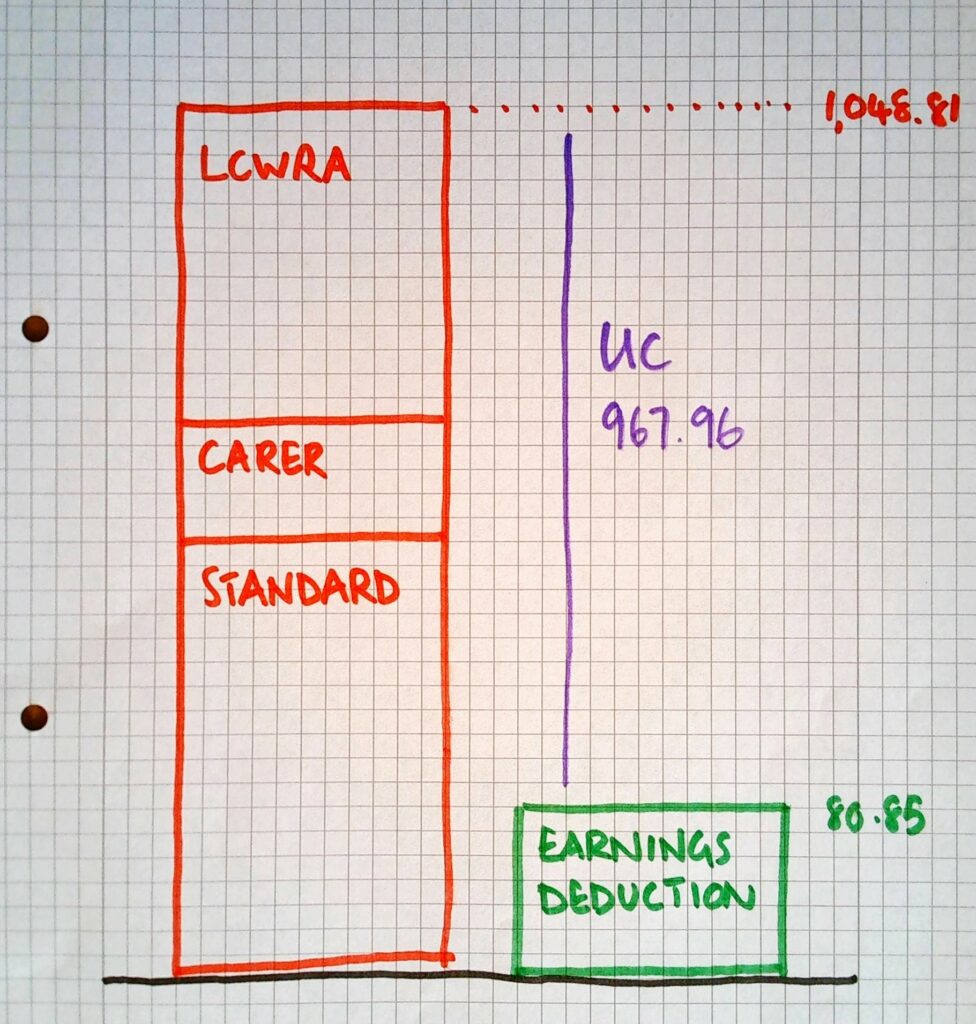

If you are a carer, Universal Credit allows a Carer Element of £168.81 in your maximum-amount (needs-level).

She counts as his carer if she cares for him for 35 hours each week, but only after his PIP has come through.

She should explain that she is caring for him right from the outset of the UC claim even before the PIP is awarded.

This will help prevent problems with back-paying the extra element once the PIP comes through.

Getting More Because He Is Unwell

If you have an illness or disability that impacts on your ability to work, you can get the DWP to do a Work Capability Assessment

If this assessment decides that you have a severe condition (both LCW and LCWRA), Universal Credit includes an LCWRA element of £354.28 in your maximum-amount.

To trigger the Work Capability Assessment he should submit a sick-note along with his UC claim.

There is a three month waiting period for this LCWRA element.

Getting More From Her Wage

If his Work Capability Assessment decides that he has Limited Capability for Work, they get a Work Allowance in the UC calculation.

UC will ignore part of her wage when they do the what-you-need-vs-what-you’ve-got calculation

In their case, UC will ignore £573 of the wage, so the earnings deduction will be:

Wage £720 – Work Allowance £573 = £147

£147 x 0.55 = £80.85

The Final Answer

So, once all this is sorted out the UC will be £967.96 per month:

What This Post Hasn’t Told You

This post hasn’t explained why they get that amount of work allowance.

This post hasn’t told you how it would be different if they were renters

It hasn’t explained anything about backdating the work-allowance.

It hasn’t told you what will happen once they both get to pension age (66)

Nor has it told you about Council Tax Reduction – Which they should claim as soon as possible.

Sign up to my mailing list and maybe I will deal with these things another day.