Employment and Support Allowance is a benefit for people whose illness or disability means that they have Limited Capability for Work

If you made your claim for ESA before Universal Credit arrived in your area, the DWP will call it old-style-ESA.

There are two parts to old-style ESA: contribution-based and income-related.

You might get just one of these, or a combined payment.

If you’ve claimed ESA since Universal Credit arrived in your area, the DWP will call it new-style-ESA.

This is pretty much the same thing as old-style contribution-based ESA.

You might get this on its own, or combined with Universal Credit

Contribution-Based ESA: Old-Style and New-Style

Whether it’s old-style or new-style, to get contribution-based ESA you must have worked and paid National Insurance in the couple of years before you make your claim.

Because it is a non-means-tested benefit you can claim it regardless of income* and savings.

Because it’s a non-means-tested benefit, it’s an individual entitlement. You can claim it regardless of whether or not you have a partner.

Old-Style, Income-Related ESA

Income-related ESA is a means-tested benefit. If you have a partner, you must make a joint claim.

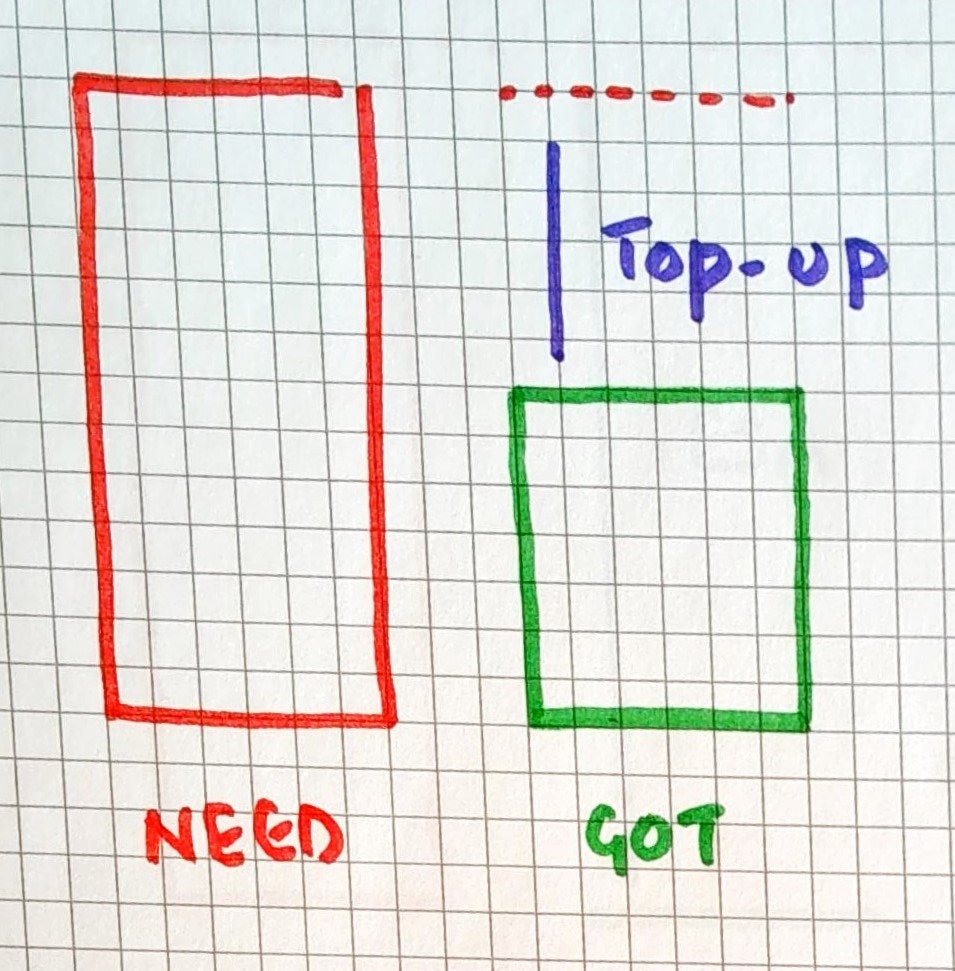

Because its a means-tested benefit, every claim gets its own needs-vs-income calculation.

The DWP works out how much you need to live on each week, using a menu of government figures.

If your income, including contribution-based ESA, is less than your needs-level, you get a top-up of income-related ESA.

The needs level is individually worked out for each claim.

It looks only at you, or you and your partner. If you have children you have a separate claim for Child Tax Credit. If you pay rent, you have a separate claim for Housing Benefit

Universal Credit

Income-related ESA is a means-tested benefit. If you have a partner, you must make a joint claim.

Because its a means-tested benefit, every claim gets its own needs-vs-income calculation.

The DWP works out how much you need to live on each month, using a menu of government figures.

The needs-level takes account of you and your partner, your children and your rent.

Diifferent Possibilities: Old-Style

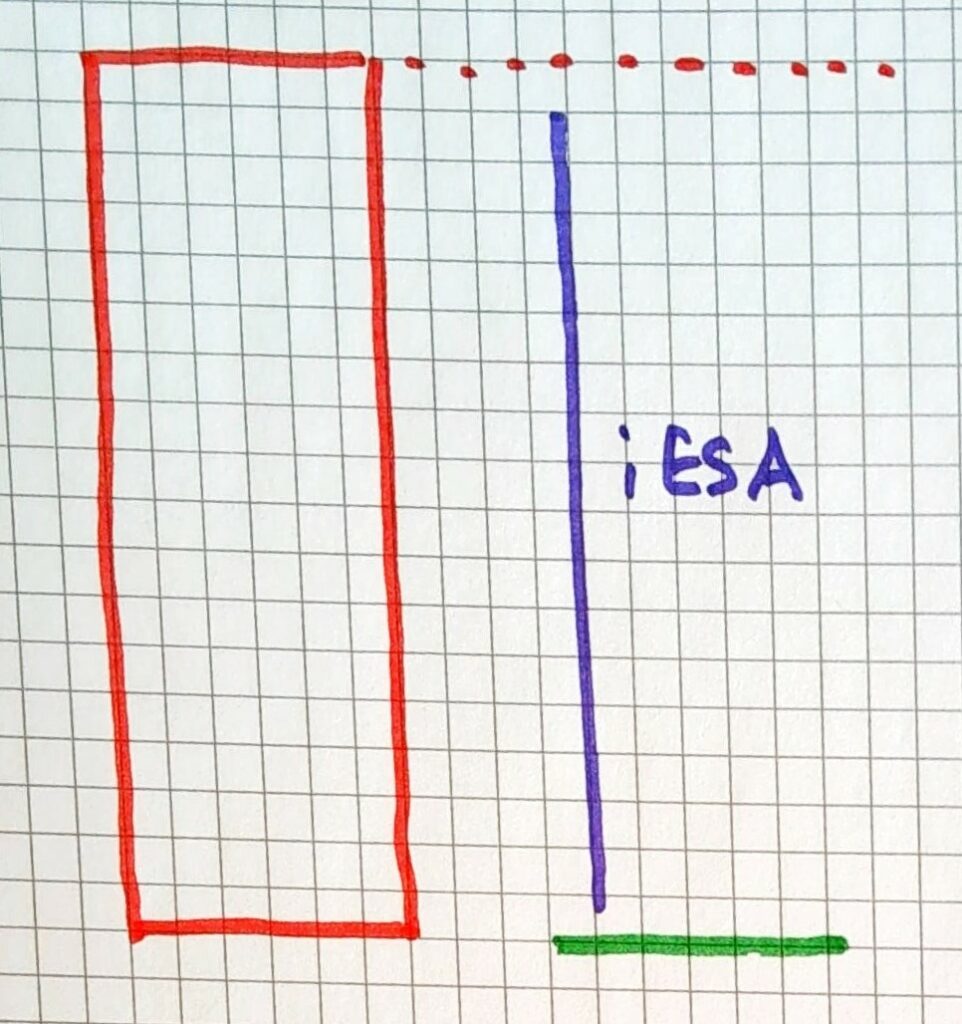

Amanda worked before she became ill. She lives with her partner Abigail who is in well paid work.

She claimed ESA before Universal Credit arrived.

Amanda gets old-style contribution-based ESA, but they don’t get old-style income-related because Abigail’s wage makes then too rich for a top-up.

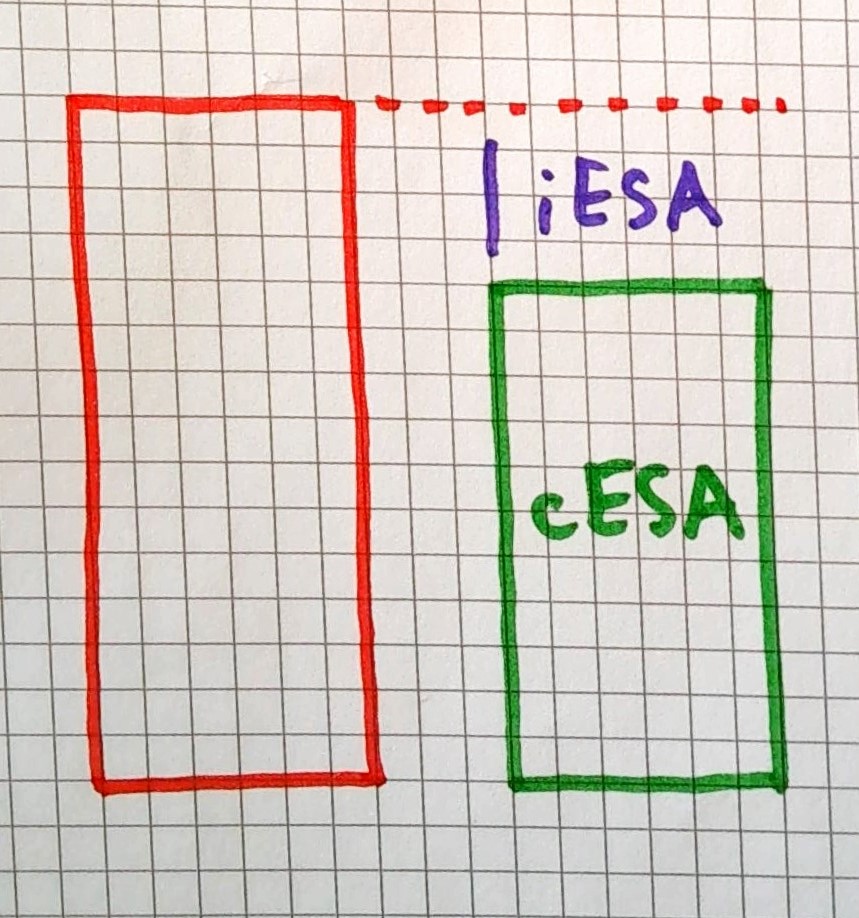

Bernard worked before he became ill. He lives alone.

He claimed ESA before Universal Credit arrived

He gets old-style contribution-based ESA but because this does not meet his needs-level he also gets a top up of old-style income-related ESA.

Charanjit didn’t work in the couple of years before she became ill.

She claimed ESA before Universal Credit arrived.

She can’t get contribution-based ESA because she doesn’t have a National Insurance record.

She gets income-related ESA to bring her income (of zero) up to her needs-level

Different Possibilities: New-Style

Amarando worked before he became ill. He lives with his partner Alexander, who is in well paid work.

He claimed ESA after Universal Credit arrived.

He gets new-style contribution-based ESA but they don’t get Universal Credit because Alexander’s wage makes then too rich for a top-up.

Belinda worked before she became ill. She lives alone.

She claimed ESA after Universal Credit arrived.

She gets new-style contribution-based ESA, but because this does not meet her needs-level she also gets a top up of Universal Credit.

DWP staff will often say that there is no need for Belinda to claim new-style, contribution-based ESA since she ends up with the same amount of money from the combined benefits that she would get from claiming only Universal Credit..

This is poor advice. Although the amounts may be the same, there are advantages to getting the new-style contribution-based ESA while she can.

Charles didn’t work in the couple of years before he became ill.

He claimed ESA after Universal Credit arrived.

He can’t get contribution-based ESA because she doesn’t have a National Insurance record.

He gets Universal Credit to bring his income (of zero) up to his needs-level

Bonus Bits for Benefit Nerds

Dudley didn’t work in the couple of years before he became ill. He has £18,000 in savings

He can’t get contribution-based because he does not have a National Insurance record.

He can’t get income-related because his savings exceed the £16,000 limit

He can still have a live credits’only claim though to get the National Insurance credits that will protect his eventual right to get Retirement Pension.

Edwina used to get old-style contribution-based ESA along with an old-style income-related ESA top up – Just like Bernard, above.

She had to claim Universal Credit when she moved to a new home in a new council area – because she needed help with rent.

Her old-style contribution based was converted to new-style contribution based.

She now gets this with a Universal Credit top-up – Just like Belinda, above.

Frank gets old-style contribution based ESA, but he didn’t realise that – just like Bernard, above – he should be getting a top-up of old-style income-related ESA as well.

When he asked the DWP about this he was told that he couldn’t get the extra because ESA is closed for new claims.

This is wrong though since he wouldn’t be making a new claim. He can still get the top-up now.

*

Georgia gets contribution-based ESA.

Because she has private and work pensions over £85 per week her ESA is reduced.

This is the only form of income that can affect non-means-tested ESA.

It applies to both old-style and new-style contribution-based ESA