This post was updated on 4 October 2024.

Work Capability Assessments

Employment and Support Allowance is a benefit for people whose health problems or disabilities put barriers in the way of work.

Universal Credit is a benefit for anyone under pension age, but you get a different deal if you have health problems or a disability that make work difficult.

So, the benefits system has to have a system for assessing the work-related effects of illness or disability; and that system is the Work Capability Assessment.

The DWP loves to give things two different names so they might refer to the Work Capability Assessment as the Health Journey [Ffs!]

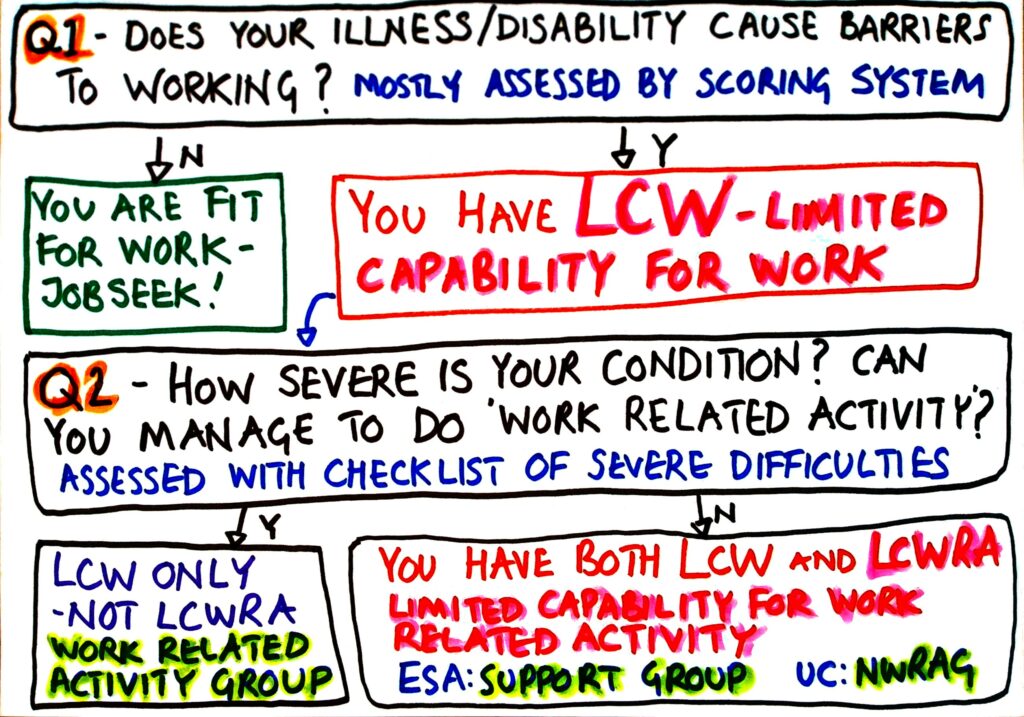

There are two parts to a Work Capability Assessment:

Step 1 – Limited Capability for Work – LCW

Limited Capability for Work is benefits-system-jargon to mean that you have an illness or disability that either prevents you from working, or makes working difficult for you.

Some people automatically get treated as having Limited Capability for Work, but usually a scoring system is used to assess your physical, mental and cognitive functioning.

If you don’t get an automatic pass and you don’t score the points, the benefits system says that you are fit-for-work.

If you pass this part of the assessment you are said to have LCW – Limited Capability for Work

Step 2 – How Severe is Your Condition? WRAG or Support Group?

If you are found to have Limited Capability for Work you won’t be expected to job-seek, but you might be required to do some stuff to look at getting back to work in the future; so-called Work Related Activity.

The second part of the Work Capability Assessment looks at whether you could manage this, or whether your condition is so severe that you have Limited Capability for Work Related Activity – LCWRA (Ffs!)

If you can manage the Work Related Activity you are said to be in the Work Related Activity Group.

If you have a more severe condition you are said by ESA to be in the Support Group, or by Universal Credit to be in the No Work Related Activity Group. (DWP loves to give two different names to the same thing!)

The law of Work Capability Assessments includes a list (actually a couple of lists) of conditions that would mean that you have Limited Capability for Work Related Activity.

If you don’t come into the lists there is a safety net rule that says that you should be treated as having Limited Capability for Work Related Activity if your illness or disability means that there would be a substantial risk to the health of any person of you were not treated as having LCWRA.

You can find the full scoring system and the Limited Capability for Work Checklist on pages 21-32 of my Benefit Notes.

Why You Might Want A Work Capability Assessment

You must have a Work Capability Assessment to claim Employment and Support Allowance since ESA is a benefit only for people who have Limited Capability for Work.

Universal Credit is a benefit for all adults under pension age.

If you have Limited Capability for Work:

- You cannot be required to job-seek, so there is no danger of an inappropriate sanction.

- If you do work, or if your partner works, you are allowed a Work Allowance. This means that part of your wage will be ignored in the Universal Credit calculation.

- If you were first assessed as having LCW before 3rd April 2017 you may qualify for an extra component or element in your benefit.

If you have both Limited Capability for Work and Limited Capability for Work Related Activity:

- You get an extra LCWRA element included in the Universal Credit award.

- You may get an extra Support Component and Enhanced Disability Premium in your old-style ESA.

- You are exempt from the Benefit Cap.

Migrating from ESA to Universal Credit

If you are getting old-style ESA and you make a claim for Universal Credit, DWP staff may say that you have to have a new Work Capability Assessment.

This is incorrect. The Work Capability Assessment that you had for ESA carries through to your Universal Credit claim.

If you refer to Regulation 19 of the Transitional Provisions Regulations, this will often sort the problem out.

The Work Capability Assessment Process

As part of your Work Capability Assessment you are usually asked to complete a UC50 questionnaire and then take part in a medical examination with a Health Professional who works for a private contractor

The health professional writes a report which is returned, along with any other evidence, to a Decision Maker who works for the Department for Work and Pensions.

Starting the Work Capability Assessment Process

To start the Work Capability Assessment process you must tell the DWP that you are ill or disabled. You do not have to provide a Doctor’s Statement unless the DWP tells you to do so, but it is a good idea to submit one if you can. You can upload an image of it to your journal.

If you submit a Doctor’s Statement with a new claim for Universal Credit you should be immediately referred for an assessment if you are:

- terminally ill

- pregnant and there is a serious risk of damage to your health, or to the health of your unborn child

- receiving, or are about to receive, or recovering from treatment for cancer by way of chemotherapy or radiotherapy

- in hospital or similar institution for 24 hours or longer

- Legally prevented from working because of an infectious disease

- Receiving or recovering from treatment such as dialysis, plasmapheresis or total parenteral nutrition or are recovering after one of these treatments

If you do not come into one of these categories you should be referred for an assessment on day 29 of the claim.

If you are already getting Universal Credit when you become ill, you should notify DWP of this and provide a Doctor’s Statement. If you have already signed a Claimant Commitment to say that you will job-seek in return for your Universal Credit, your employment officer can suspend your Work Search and Work Availability requirements.

If you are in work and getting Universal Credit when you become ill you should notify the DWP that you have stopped work because of illness. If you have a Doctor’s Statement, upload a photo of this to your Universal Credit journal.

If you are in work and not already getting Universal Credit when you become ill, you can make a claim for UC and tell the DWP that you are unwell

The UC50 Questionnaire

Your Doctor’s Statements may tell the Decision Maker everything that s/he needs to know to complete your assessment, but in most cases you will be asked to complete a questionnaire about the activities that are covered by the scoring system.

You have four weeks to complete the questionnaire. If you do not return it within three weeks a further copy must be sent to you. You must return this within one week.

If you fail to return your questionnaire and you do not have a good reason for this failure, you will be treated as fit-for-work.

The Medical Examination

Your Doctor’s Statements and questionnaire may tell the Health Professional everything that they need to know to write their report for the Decision Maker, but in most cases you will be asked to take part in a medical examination. You must be given seven days’ notice of the medical examination unless you accept a shorter period.

In normal times the medical examination takes place during a face-to-face meeting which will take up to 75 minutes. It will usually be at a Medical Examination Centre but it can take place at your home.

During Covid, medical examinations have been carried out by phone, and may be done by zoom in future.

If you fail to attend your medical and you do not have a good reason for this failure, you will be treated as fit-for-work.

During the medical examination you must use or wear any aid or appliance that you normally use. The examination is usually verbal but can include a short physical check-up.

The assessment of how you manage the activities in the scoring system should look at the majority of the time or the majority of the occasions on which you undertake the activity.

Decisions, Reconsiderations and Appeals

After the medical examination, the Health Professional writes a detailed report that is passed to a Decision Maker at the Department for Work and Pensions. The Decision Maker considers this along with any other evidence.

You must be notified of the decision in writing.

If you disagree with most DWP decisions you must first ask for an internal revision. If you are still dissatisfied after this Mandatory Reconsideration you can appeal to an independent tribunal.

ESA Work Capability Assessment decisions are an exception to this general rule.

If your ESA Work Capability Assessment has been completed and it had been decided that you are fit for work you can appeal directly to a tribunal without going through the revision stage.

If you failed your Work Capability Assessment because you did not return the form or did not participate in a medical you must go through the mandatory reconsideration stage before appealing to a tribunal.

If you are getting ESA when you are found to be fit for work your benefit will usually be stopped, but it can be reinstated if you provide doctor’s statements and appeal to the tribunal. You will be able to stay on ESA until the tribunal makes a decision.

For Universal Credit Work Capability Assessments, you must ask for the Mandatory Reconsideration before appealing to the tribunal.

Your Universal Credit claim can continue while you wait for the reconsideration or appeal but you may have to meet Work Related Requirements.

Whether you ask for a revision or appeal, you must give reasons. It is not enough to say that you think the decision is wrong. You must identify the parts of the assessment that apply to you, and you should provide evidence of the points that you score if this if possible.

Working While you Have Limited Capability for Work.

ESA – Permitted Work

If you are claiming ESA, you can get permission to do part-time work.

You can do voluntary work; or paid work of less than 16 hours a week, earning £183.50pw or less.

The £183.50 threshold is the weekly amount you earn if you work for 16 hours earning National Minimum Wage, rounded up to the next 50 pence

Wages from permitted work have no effect on any of your benefit entitlements.

Universal Credit

You do not have to get permission to work if you are claiming Universal Credit on the grounds that you have Limited Capability for Work.

If you start work the DWP may decide to reassess you, if your work suggests that your capability has improved since the last assessment.

Because you have Limited Capability for Work you will be allowed a Work Allowance of either £379pcm or £631pcm.

Earnings below this level will not affect your Universal Credit. Earnings above this level will cause an earnings deduction.

If you earn more than £793.17 per month at the time of your assessment, you will be automatically treated as not having Limited Capability for Work unless:

- you get Personal Independence Payment, Disability Living Allowance or Attendance Allowance, or,

- you get an automatic pass on the Work Capability Assessment.

The threshold of £793.17 is the monthly amount you earn if you work for 16 hours each, week earning National Minimum Wage for a person aged 25 or over.

Reassessments

If you have already had a Work Capability Assessment and been found to have Limited Capability for Work the DWP can refer you for a reassessment whenever they wish to do so.

If you have already had a decision that you are fit-for-work you cannot have another Work Capability Assessment unless

- the earlier decision made in ignorance of, or was based on a mistake as to, some material fact; or,

- there has been a relevant change of circumstances in relation to your physical or mental condition.

: