Hello Mike,

What can I claim if I can’t work (much) because of ill health?

Julian.

Hello Julian,

Going off-sick from work: Statutory Sick Pay

If you are already in employment and you become ill you will probably be entitled to Statutory Sick Pay.

This part of the benefits system, but it is paid by employers.

It is the legal minimum amount of sick-pay that the employer must give you, so long as you normally earn at least £123 per week

You get £116.75 per week from your fourth day of illness for upto 28 weeks.

Many employers pay more than this, or pay for longer periods

The extra is often called occupational sick-pay or contractual sick-pay because the deal that you get depends on your particular contract for your particular occupation.

No SSP? Employment and Support Allowance

If you are still unwell when your SSP ends, or if you are not in employment, you may be able to claim new-style-contributory-Employment and Support Allowance (ffs!) from the DWP.

Many years ago ESA used to have a sensible name: It was called sickness benefit.

And that is what it is: An instead-of-a wage-benefit, if you are are not working full-time because of illness or disability, which the DWP calls having Limited Capability for Work.

To get ns-c-ESA, you must have worked and paid national insurance in one of the two tax years before the year in which you make the ESA claim.

You must be working less than 16 hours each week, and earning less than £183.50 each week.

To start the claim you should submit a sicknote from your GP practice, to show that you have Limited Capability for Work.

The DWP then does a Work Capability Assessment to confirm this.

There are three possible outcomes from a Work Capability Assessment. The DWP may say that you:

- Are unwell, and that your illness causes severe effects: Which the DWP calls having both LCW and LCWRA

- Are unwell, but have an illness with less severe effects: Which the DWP calls LCW only

- Are fit-and-well, in which case you can no longer claim on the grounds of ill health – and you might have to appeal against this decision.

During the first 13 weeks of an ESA claim (called your assessment phase) you get:

- £71.70 per week if you are aged under 25

- £90.50 per week if you are aged 25+

From week 14 of your claim you get:

- £90.50 per week if you have LCW only – Maximum 365 days

- £138.20 per week if you have both LCW & LCWRA – Indefinite award

Because ESA is a non-means-tested benefit, it is an individual entitlement, that you can claim regardless of your partner’s circumstances.

It is paid regardless of saving and almost all income – though it will be reduced if you have a private pension of more £85 per week.

The reduction equals half of the amount of private pensions in excess of £85, so, a private pension of £185 would reduce the ESA by £50.

That’s not enough! Universal Credit

No! It isn’t. The amounts of SSP and ESA are shockingly low. So maybe you (and your partner) can claim Universal Credit too

UC is a means-tested benefit for all people under Pension Age.

Universal Credit works by comparing your hypothetical income, with a hypothetical amount that the government thinks that you need each month for:

- yourself

- your partner

- any children or young persons that you are responsible for

- your rent – or sometimes mortgage

If your income is less than your needs-level (officially called your maximum UC) you get a top-up to bring you up to this level.

The needs-level can include extra amounts for people who are ill or disabled: If you have LCWRA (and maybe if you just have LCW).

The needs level can include extra amount(s) if you and/or your partner are carers.

Because each Universal Credit claim gets its own needs-vs-got calculation it’s not possible to cover every situation in a blog post like this.

If you’re not getting legacy benefits and you’re not sure whether you will qualify for UC, claim anyway. You have nothing to lose by making a claim.

Here are a couple of examples of the need-vs-got calculation:

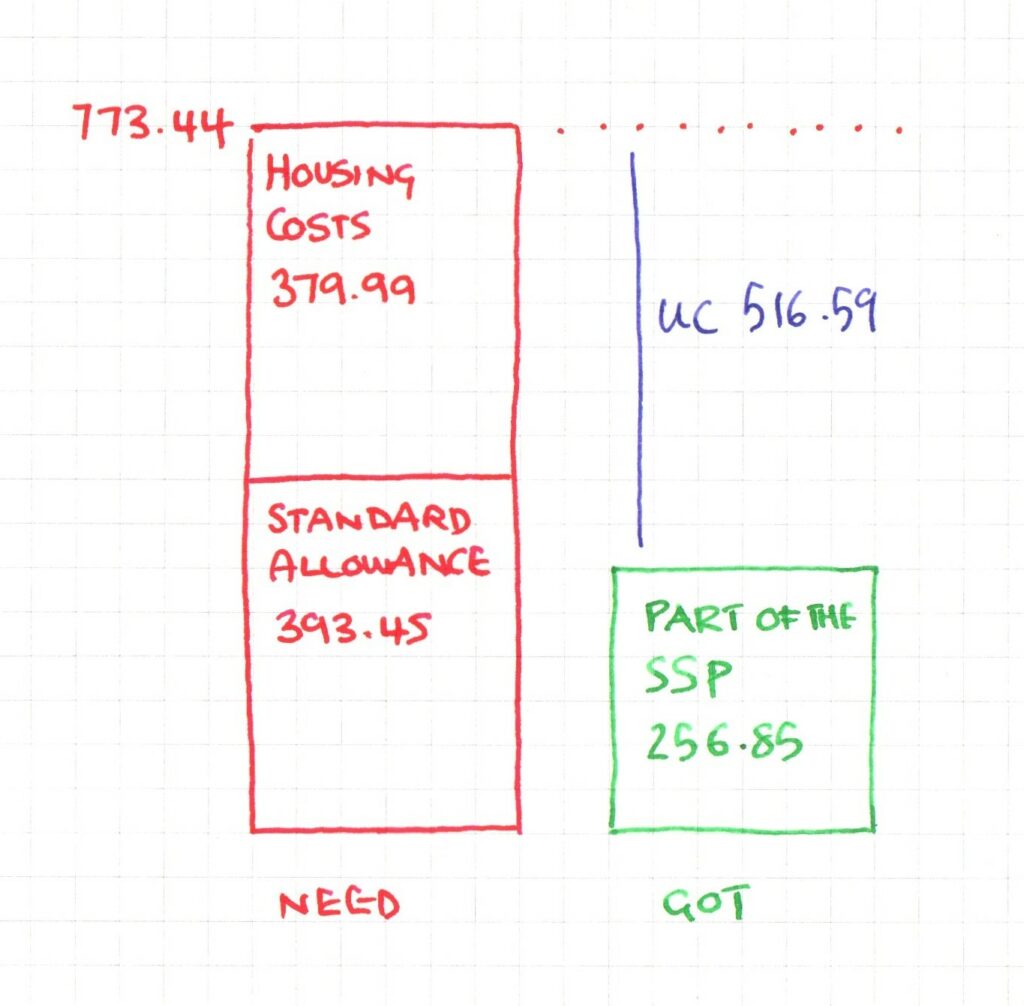

Anna (26) is off-sick from work getting statutory sick pay of £116.75 per week.

She lives alone in a privately rented flat in Nottingham.

Universal Credit thinks that she needs just £773.44 per month.

UC counts only 55% of her SSP in the calculation – Which comes to £256.85 per month.

Her UC is £516.59 per month.

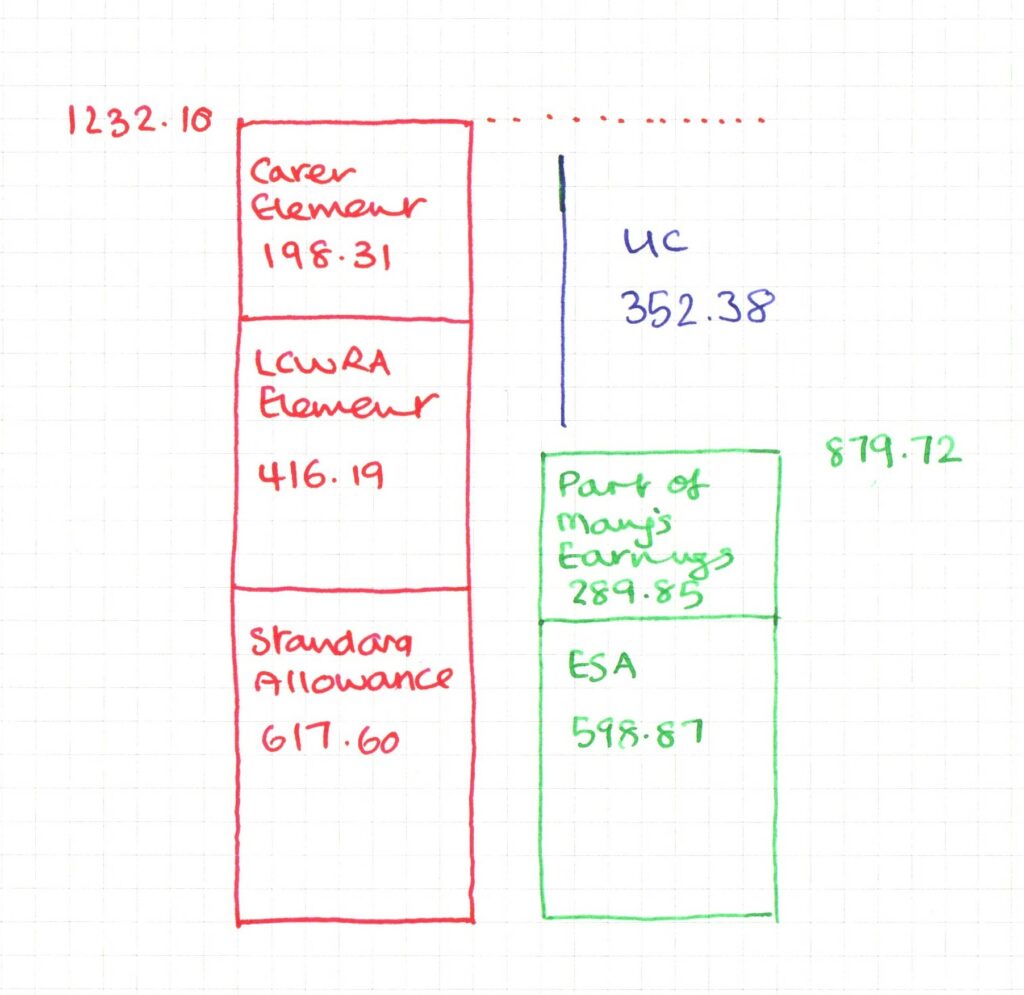

Miranda (36) lives with her partner Mary (36).

Miranda’s SSP ran out and she claimed ESA – She has had her work capability assessment which found that she has got both LCW and LCWRA.

Miranda also gets PIP-Daily Living Component of £72.65 per week

Mary works part-time with take-home pay of £1,200 per month

They live in a mortgaged property.

UC thinks that they need £1,232.10 each month.

When totalling their income UC ignores the PIP, counts the ESA, and counts part of Mary’s wage

Claim UC As Soon As You Can

Because of some quirky, and fairly complicated rules, if you think that you might (eventually) be entitled to Universal Credit you should claim as soon as you can – Even while you are still getting sick-pay from your employer.

You should upload a copy of your sick-note to your UC journal.

Doing this will bring forward the date from which UC allows extra money for illness/disability

Getting your claim in as soon as early as possible can allow you a better deal in relation to earned income in the needs-vs-got calculation.

Where does PIP fit into this?

PIP is not work-related. You can claim while you are working – so long as what you tell them about your care and mobility needs is consistent with what you are doing for work.

There’s loads more information about PIP here